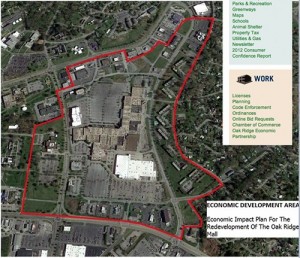

The Oak Ridge Mall economic development area is pictured above. The map shows a contiguous area that could be affected economically by the proposed development, which only includes the former 60-acre mall property, according to a city consultant. (Image courtesy City of Oak Ridge)

A city board this month will consider a financing arrangement that could be worth up to $10 million and allow a North Carolina company to use new property tax revenues generated at a redeveloped Oak Ridge Mall to be used for site development, possibly including for roads, stoplights, and demolition work.

Many of the details aren’t available yet, including the precise amount of the proposed tax increment financing, or TIF, agreement and the length of time it could be in effect. The details will be discussed at a Sept. 26 meeting of the Oak Ridge Industrial Development Board, when members will consider an economic impact plan, city consultant Ray Evans said.

The economic development area could include about 90 acres. It would include the 60-acre mall and could include an apartment complex and museum, movie theater and pizza shop, real estate firm and hotel, and several busy stores on Oak Ridge Turnpike—properties that could benefit from the TIF, Evans said.

“The TIF legislation calls for the establishment of a

contiguous area that might be economically impacted by the proposed development,” Evans said. “The proposed development includes only the former mall property.”

He said he is not aware of any plans by the owners of the other parcels to redevelop their properties.

“The map showing the economic impact area is not meant to imply that there are plans to redevelop the apartment property, the American Museum of Science and Energy property, or any other tracts within the boundary other than the former mall property,” Evans said.

Oak Ridge has used a TIF before, though on a much smaller scale, to help developers build Panera Bread, Aubrey’s, and Aldi on South Illinois Avenue. That TIF also includes the former Dean Stallings Ford car dealership.

The special IDB meeting is at 3 p.m. Sept. 26, and it will include a public hearing in the Oak Ridge Municipal Building Courtroom at 200 S. Tulane Ave. During that meeting, the IDB could recommend the mall TIF to the Oak Ridge City Council and Anderson County Commission.

City officials emphasized that no public money would be at risk in the project, separating it from other earlier retail development proposals that were rejected by voters, including one about a decade ago at the mall and the other on top of Pine Ridge. Those financing packages, which put a significant amount of public money at risk, were subject to referendums, but the TIF would not be, Oak Ridge officials said.

“We’re approaching this differently than the others,” Evans said.

The mall redevelopment has been proposed by Crosland Southeast, a development and investment company headquartered in Charlotte, N.C. That company signed a contract in late January to buy the mostly empty mall from Oak Ridge City Center LLC, although the deal hasn’t closed yet.

Evans said the redevelopment would include demolition of interior spaces between the two remaining anchor stores, Belk and JCPenney. Those two stores would stay as would the portion of the building next to JCPenney that once housed Downtown Hardware.

Redevelopment plans have languished since 2002, when Oak Ridge voters rejected a controversial $23.2 million bond resolution that would have supported a plan to convert the mall into a town square that would have included new school administration headquarters and a senior citizens center.

Evans said there are estimates that the redeveloped property could generate $85 million to $90 million in sales revenues per year, and the city and county would collect a combined 2.75 percent in sales tax revenues on those purchases.

“I think folks are so anxious to get a quality improvement,” Evans said. “It’s quality of life for the community. It’s the psychological impact of not having a property like that sitting there.”

“It’s fun that it’s finally come to fruition,” Oak Ridge City Manager Mark Watson said.

Note: This story was updated at 11:45 a.m. Sept. 13.

Jason Allison says

I am cautiously optimistic. This development is greatly needed but I’m worried people still have a bad taste left after the Arnsdorf debacle. Things in Oak Ridge are starting to look good and I’m sure everyone wants that to stay in the right direction.

johnhuotari says

I’ve heard no opposition to this proposal. These are definitely the best times in terms of economic development that I’ve seen in the 13 years I’ve been in Oak Ridge.

Jason Allison says

I’ve said it many times. I grew up here, 37 years, just as Mr. Hinds and yourself have pointed out, I’ve seen go from good to bad and It’s about time we start seeing things everyone can agree on.

Bob Hinds says

I hope this is for real. In the 26 years we’ve lived in Oak Ridge we

witnessed the best of times, and the worst of times. Hopefully, this

will bring back the great promise of the 90’s.

KAY ALLISON says

I’m waiting to hear what they are going to do with the apartment complex they think they need to have. What are they going to do with the “nice” people who live here on SS. can’t afford to rent on of those ‘modest priced apts. and what do they need with the Museum?

TJ Garland says

Sell the golf course. Put it back on the tax rolls. Several hundred thou a year in improved cash flow. The city does not need to compete with private enterprise.

Jason Allison says

I don’t think they plan on “doing” anything with them other than including the property within the proposal map. If you look, the museum is also included. Now we know no one wants anything to be done with that.

Ken Mayes says

Maybe John can get those questions answered.

johnhuotari says

Kay, I have asked about the Manhattan Apartments. It’s my understanding, based on my conversations with Ray Evans and Mark Watson, that the map for the TIF area includes properties that have perceived benefits. Mark Watson said the apartments are part of a contiguous district. He said is not aware of any plans for them.

Kay and Ken, regarding the museum, my notes aren’t real clear on whether there have been or will be discussions with the U.S. Department of Energy about including AMSE and the AMSE property. Mark Watson said it may or may not be included.

It seems that a TIF area can include properties that aren’t immediately affected. For example, Ray Evans said the TIF for Aubrey’s and Panera also included the former Dean Stallings Ford, although nothing significant has happened there.

I’ll try to get some clarification on this.

Ray Evans says

The TIF legislation calls for the establishment of a

contiguous area that might be economically impacted by the proposed development. The proposed development includes only the former mall property. I am not aware of any plans by the owners of the other parcels to redevelop their properties. The map showing the economic impact area is not meant to imply that there are plans to redevelop the apartment property, the AMSE property or any other tracts within the boundary other than the former mall property.

johnhuotari says

Thank you, Ray.

johnhuotari says

I updated the story with your comments.

Ken Mayes says

Thanks for the clarification, Ray. It must be a complicated formula because I would have assumed a general radius of X would have sufficed for economic impact. Just out of curiosity, were the businesses at the corner of Tulane & OR Turnpike and several business along the Turnpike excluded due to the type of businesses they are?

KAY ALLISON says

Thank you for answering my questions. In the picture all you see is the red line going around the property and no real explanation of what is for. It was misleading to me anyway