I agree with Martin McBride that Oak Ridge is a great place to live. However, I do not agree with his statement in recent columns that high property taxes are the reason Anderson County’s and Oak Ridge’s populations are not growing as fast as those in some area counties.

The following information from county and city audit reports and websites, the University of Tennessee County Technical Advisory Service, and the U.S. Bureau of Labor Statistics website help make my point.

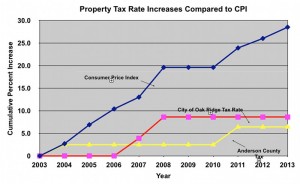

Oak Ridge and Anderson County taxes are rising much slower than the CPI

As shown in the graph to the left, Anderson County has had just two tax rate increases in the last 10 years that have resulted in a total county tax rate increase of 6.4 percent for Oak Ridge residents. Oak Ridge’s city taxes have not gone up in six years and have increased a total of only 8.6 percent in 10 years. Impressive when you consider the Consumer Price Index has gone up 28.5 percent during those 10 years.

Stated another way, an average resident paying $1,500 per year in combined county and city taxes has seen county taxes go up $48 and city taxes $65, for a total increase of $113 (or 7.5 percent) in 10 years. If taxes would have gone up at the rate of other goods and services based on the CPI, combined taxes would have gone up $428 in those 10 years.

Oak Ridge taxes are comparable to other nearby full service cities

Knoxville residents pay city and county taxes at total rate of $4.82, Maryville pays $4.32, Alcoa $4.15, and Oak Ridge $4.74. Knox County also has a wheel tax, and Blount Count is currently voting on one.

Homeowners in Knoxville pay slight more in property taxes than those in Oak Ridge. A homeowner with a $100,000 home in Maryville pays $105 less each year in property taxes than in Oak Ridge. I doubt most folks are willing to drive an extra half-hour each day to work to save $2 per week on taxes.

Anderson County taxes are in the middle range of area counties and the State

County property tax rates in the Oak Ridge portion of Anderson County are the same as Knox County. Our property taxes are the same as the average of the six counties bordering Anderson County if you factor in wheel taxes that are in place in five of these six counties. If you factor in population, most Tennessee residents pay a higher county tax rate than Anderson County.

Many other cities are not full-service cities like Oak Ridge, so costs for these services must be factored into tax rates when making comparisons. Farragut is in a unique situation in that it receives substantial sales tax revenue as a regional retail center—with the help of county tax breaks provided to many of its retail developments.

With tax rates held flat for 10 years – where is the growth?

Data from the last 10 years do not support Mr. McBride’s claim. According to Mr. McBride, the reason Oak Ridge and Anderson County lag in population growth are increasing property tax rates. If property taxes were the main factor in deciding where to live, we would have expected more growth after holding the tax rate almost flat for over 10 years.

How do we grow?

Mr. McBride is correct in saying our population growth rate in Anderson County and Oak Ridge is lower than several other area counties. There probably are many reasons why—with some factors we cannot control. But I do not believe relatively small property tax differences is the reason.

Improved retail is one way to increase population growth. Retail is improving, and I believe it will help attract residents and generate sale tax revenue to help pay for vital services.

No one likes taxes. We must continue to work hard to hold the line on property taxes to the extent possible, but we should also maintain high-quality services. The services are the reason many of us chose to live here.

One thing we can all do to help growth is to spread the word about what a great place Oak Ridge is to live. I agree with Mr. McBride that outside Realtors are probably pressuring new Oak Ridge workers to locate outside Oak Ridge. We don’t need to give these outside Realtors information to use against us that is misleading and not supported by facts.

Myron Iwanski represents Anderson County Commission District 8 in Oak Ridge.

Mike Mahathy says

Myron, You are as wrong as you could possibly be though I am not faulting you and I personally am not saying taxes on Oak Ridge are too high. However, as a person who lived in another local city and made the decision to move to OR (only for schools) I can tell you the perception of high taxes in OR was real 7 years ago (more true then) and lingers on. Remember that perception is reality.

Mike Mahathy says

This timely article underscores another one of Martin’s points, that workers commute in. Honestly I’m not sure lowering taxes would make a difference though maybe in the long run as new workers come to the area. Oak Ridge has finally starting getting more restaurants and shopping options which will help too.

http://oakridgetoday.com/2013/05/21/y-12-recognized-as-a-best-workplaces-for-commuters/

Bill Issel says

But he is not wrong.

Denny Phillips says

Classic politician bull-malarkey.

Myron, since you are going to go ahead and factor in wheel tax to the equation to achieve your desired outcome, how about you factor in sales tax when comparing Knoxville to Oak Ridge?

Mike Mahathy says

Beth, As a person who lived in another city I assure you that most non-Oak Ridgers think our tax rate is too high. And while Myron compared us to cities with property tax (notice we are 2nd highest) Martin compared us to Farragut. How about doing the comparison, Myron, to Kingston, Clinton and Lenoir City.

TJ Garland says

Myron has misspoken.

Elected politicians always bray about how they kept tax rates the same during their watch. The never reveal that assements usually go up, because the governments ALWAYS need more money every year.

I moved here 11 years ago, and became a substantial tax payer. My land and personal property taxes have increased a lot.

Governments sneak in increases in various fees, licenses, fines, permits, utility bills, etc., that are usually applied to businesses, so that the man on the street is not aware that he just paid a little more for the hamburger at McDonalds for this reason.

I’m sure Myron can tell us the County total annual budget for the last ten years. Taxpayers paid it all, one way or the other.

The tax equalization board is infamous for not lowering assessments when called for. Another way to brag about low tax rates.

Retail is not the answer, except in a major tourist destination. We are not. Mining, manufacturing, farming, and businesses that bring money into the area are the answer. Retail sends our money out of state or country, where the item is made or grown. They become prosperous.

Denny Phillips says

I agree with 100% of this post.

Two minor notes:

1. One of the two county tax hikes that Commissioner Iwanski referred to occurred during his temp-administration. He and Commissioner Isbell were sure to strike while the iron was hot by jacking up taxes and indebting citizens by borrowing money for industrial property that they haven’t found yet (I call it “Walking Around Money”) and for capital outlays that they still haven’t identified (the most recent attempt to spend it was to build a special building for the Election Commission that works every two years). The citizens are saddled with the debt management on these monies and the accruing interest.

2. I think you will find the change of guard at the AC Property Assessors office to be much more tax-payer friendly. John Alley already did yeoman’s work on helping our non-profit receive the adjustment that the state had ordered 3 years ago including a rebate for the overcharge.

Ck Kelsey says

John ,what happened to my post ?

johnhuotari says

Which comment? I haven’t removed any of your comments on this column.

Ck Kelsey says

Something strange has happened to both posts.

Myron Iwanski says

A few thoughts in response to comments that are related to the subject of my column:

Perception is reality

– I agree when it comes to perceptions about taxes. That is why we need to get the real facts out to change the perception.

Why compare Oak Ridge to Maryville and Alcoa?

– Because these cities support full service city school systems that are comparable to Oak Ridge. Kingston does not have its own city school system. Clinton only offers city schools through 6th grade. Even with one of the lowest city property tax rates in the state, Clinton has not

had much population growth and many of the employees in its industrial parks live outside the County. So low taxes did not lead to the population growth Mr. McBride claims come with low taxes.

Assessments go up,which means more tax revenue for the City and County

– This is not true. By state law, property reappraisals are revenue neutral. If the total county appraisal goes up say 20% in 5 years, the state adjusts the county tax rate down by 20%. Taxes are just redistributed with some winners and some losers. So in reappraisal years some pay more some pay less, but on average it is a wash.

The county revenues trend line shows increases in revenue in years there is a property tax rate increase, but no revenue increase in reappraisal years. For a good explanation of how this works go to http://ellensmith.org/blog/2013/05/26/trying-to-set-the-record-straight-on-property-tax/

I am not going to response to the handful of the County Mayor’s friends and relatives who constantly use these blogs for political attacks that are not even on the subject.

Denny Phillips says

Lol. Hate to break it to you, but that is a response!

Ck Kelsey says

“Revenue Neutral” is a scam .It allows politicians “Weasel room” while they raise the rate of the TAX. In reality , it is only delayed . You know that in Anderson Co. we paid more property TAXES for quite a few years in a row.Some of those were so called “Revenue Neutral” .That’s faux benevolent leaders taxing language and for people with common sense it’s hogwash . The power to TAX is the power to destroy . Nothing new under the Sun.

Ck Kelsey says

Myron ,How is the above post by me , “Out of Context” ?

Ck Kelsey says

Mr. Iwanski .Would love for you to reply to us out here for your decisions .Just once .

Mike Mahathy says

Myron,

I am not trying to be argumentative but first the Knox Co/Knoxville rate is $4.80 rather than $4.82. That is still a little higher than the combined OR rate of $4.74.

However, the combined rates for Maryville and Alcoa, cities you deemed worthy of comparison are considerably lower. It is hard for us to compete with any of those three and the record shows that though OR is making some dents.

In addition Knoxville has a competitive business advantage over us by being a interstate hub. While Martin did not specifically talk about that aspect, a lower tax rate would help increase our competitiveness and he did say that.

Personally I feel conflicted because I am not advocating for a tax reduction as I want great schools but it may come with less business, and less people moving here.

To openly compete with Knoxville, Maryville and Alcoa our tax rate is a big anchor we are pulling around on top of being miles from an interstate. Of course the city can just hand out tax abatements but that’s another topic.

Martin and I do not agree on some things just like you and I wouldn’t but I respect his position and he made a good point.

Myron Iwanski says

The CTAS December 2012 publication and the City of Knoxville website list the Knox County tax rate as 2.36. The Knoxville website also lists the city tax rate as 2.46. This totals to 4.82.which is what I used in my column. Maybe the Knoxville city website is wrong.

One of my reason for comparing tax rates was that Mr. McBride stated that those working in Oak Ridge are chosing to live elsewhere because of tax rates. I don’t think many working in Oak Ridge would commute for long distances for what amount to 30 cents a day (or even $1 per day for a large home) differnce in property taxes.

Ellen Smith says

The Tennessee comptroller’s office has the same data that Myron used. See http://www.comptroller.tn.gov/pa/LR.asp?W=12

A while back, I worked out that the combined city-and-county property tax rates paid by Anderson County Oak Ridgers for 2012 were less than the total property tax in 19 other Tennessee jurisdictions, including Knoxville, Chattanooga, Memphis and several of its suburbs, The Roane County portion of Oak Ridge was a good bit farther down the ranked list. Details are at http://ellensmith.org/blog/2012/12/12/revisiting-the-property-tax-rate-comparison/

Like Myron said, these comparisons don’t include wheel tax in many communities.

Also, property tax is just one little piece of the cost of living. The choice of where a person or family lives also affects commuting costs, differential rates for homeowners insurance in areas lacking city fire protection services, etc., etc. Recently I’ve seen analyses suggesting that a substantial number of households in our region spend more money on transportation than they do on housing. According to the analysts, that’s particularly likely to be true in rural communities.

Mayor's mom, Anne Phillips says

Normally I refrain from posting but you, Mr. iwanski, have inspired me. It may surprise you to know that the “County Mayor’s friends and relatives” happen to be intelligent and well-informed individuals with minds of our own capable of understanding and challenging the validity of your statements. My own three children were born at Methodist Medical Center, graduated from Anderson County High School, went away to colleges, and CHOSE to return to Anderson County to live and raise their children, my grandchildren. We are business owners, property owners, and taxpayers and have a vested interest in the future and viability of this county. For you to dismiss our views and comments for your own personal petty, self-serving purposes is offensive and indicative of your lack of respect for those who may challenge your views. Perhaps you should reconsider submitting “opinion” pieces if you only want comments from those individuals who agree with you.

Charlie Jernigan says

It would be more interesting if you had actually challenged some of his statements.

Myron Iwanski says

You are taking my comment out of context. If you re-read my post, it says “who constantly use these blogs for political attacks that are not even on the subject.†If you read Denny Phillips posts and those by C K Kelsey I think you can see that there are largely political attacks questioning motives and that much of it not related to the subject being discussed in my column. I said I would not respond to those comments. I am always willing to debate issues with anyone in a civil discussion.

Anne Phillips says

I did not realize that Oak Ridge Today sets a limit on the number of posts permitted on these “blogs” nor do I understand your concept of “political attacks”. Attacks are usually violent in nature which those comments were not, and, like it or not, Mr. Iwanski, the very nature of your elected position makes any discussion with you on a topic over which you have control “political” in nature. Your motives, by the fact you are an elected official, will and should always be in question and any citizen should be able to challenge those motives. It is his or her tax dollars you are after. As temporary mayor you spearheaded a huge property tax increase which included increasing the tax rate of Oak Ridgers in addition to those of us who are strictly county residents in addition to those residents of Lake City, Oliver Springs, Norris and Clinton. That makes your statement that “we should CONTINUE to hold the line on our property taxes” laughable. Your premise that the comments were “not related to the subject being dicussed” in your column is false. When you say the word “tax” we are all participants and may refer to any and all government services which are paid for with our tax dollars. As an elected official you are empowered with the ability to confiscate our dollars for whatever motives or reasons you as an individual may deem necessary. ANY citizen has every right, and, frankly, a duty to question you and your motives as it is YOU who has the power to confiscate those dollars from us citizens. I suggest you ask John to disable the comments section if you cannot distinguish between discourse and attacks. Or you may simply avoid submitting opinion pieces to prevent misinterpretation and discussion of your statements. I believe the State of Tennessee suggested Anderson County create its own webpage to enable commissioners to debate government issues in public to prevent violations of the Sunshine Law and to allow citizens an opportunity to voice their opinions and participate in those discussions. It sounds like an outstanding idea. This could be a real opportunity for commissioners and citizens to work together for the betterment of Anderson County as well as to develop an understanding of the functions of government.

In politics there is a saying, “perception is everything”. I perceive your comments as stating in your “civil” way, “if you don’t agree with me, “Shut up, I refuse to talk to you.”

Myron Iwanski says

Everyone has the right to comment as often as the want and can say whatever they want. Like everyone else I have the right not to respond to comments I do not consider civil or relevant. You and I just disagree on what is civil and relevant. I am ok with that.

Sam Hopwood says

Oh come on Myron, you are a pretty smart fella. It’s time to put the vendetta to rest and begin to figure out who you and our liberal Oak Ridge friends will run against the County Mayor next year. Who will the sacrificial lamb be? Surely not that liberal Oak Ridge lawyer again. Perhaps Jim H or Rick M? There are all kinds of possibilities if you guys really put your minds to it. I think David B. is off the table since he just took a new job in Kingston. What do you think??

I’ll duck and await the onslaught…….

johnhuotari says

Just to clarify: We do moderate comments on Oak Ridge Today, so as outlined in the commenting guidelines, there are a few limitations on what people can say and how often they can post.

Ck Kelsey says

Wow John ,more disappearing posts ? Why?

johnhuotari says

Which posts or comments are you referring to? I don’t think I have removed any comments from this column.

Ck Kelsey says

Tue evening I wrote a long post that replied to this letter by Myron. Then yesterday I wrote a paragraph about Myron’s use of Hegelian dialectics in reply to Anne Phillips post. They have both shown up and then went poof .

johnhuotari says

I apologize if your comments have disappeared. Are you sure you hit the post button?

I haven’t heard of any problems with Disqus, our commenting system, but I’ll check into it.

Pat Fain says

While I agree with your points on taxes, I think that the more salient point is that these taxes pay for services to the public and until a majority of the public says that they want less public services, the money will have to be found.

Real estate is only reassessed every 5 years and during the intervening years inflation has lately been about 2% per year. This means that everything costs an additional 2% every time a budget is passed and at the end of the five year period the costs will have risen significantly while taxes have been flat resulting in an ever growing gap between the services we want and the revenue we collect when revenue is flat.

The end result is that when the feds threaten to and actually fine us for clean water/sewer violations we are already in the hole and have to borrow money. Either paying the fines or paying for clean water are the only alternatives. The feds can cut off all federal money in the final analysis. The alternative is to shut down the city entirely. Unfortunately we just end up paying the debt. If we had been willing to pay just a bit more each year to keep up with inflation, we could have avoided most of the debt, because we would not already be in such a deep hole. The failure to see the big picture and to confront the alternatives and to understand that there are unintended consequences to every action is the real problem. Pat Fain

Trina Baughn says

“until a majority of the public says that they want less public

services, the money will have to be found.â€

The people who perpetuate the myth that “cutting

taxes = cutting services†know as well as the rest of us that it is, in fact, a lie. Call it what you like, fat, waste, or inefficiencies, every organization, private, nonprofit or government has it. Why won’t they simply acknowledge this

as fact? Because most politicos would then be forced to make tough decisions. They might have to hurt someone’s feelings.

“Either paying the fines or paying for clean water are the only alternatives.â€

This is yet another myth (the one that says “we really don’t have a choiceâ€) perpetuated by those who refuse to hold others accountable for the messes they created. It’s easier to make the taxpayer pay for it rather than identify the source of waste or incompetency or find alternative funding solutions. I won’t rehash it here, but for those who want to know the true reason why their water and sewer rates continue to increase, read more here:

http://trinabaughn.com/2013/02/24/the-rest-of-the-epa-mandate-storyfinal-plea-to-my-fellow-councilmembers/

Charlie Jernigan says

Your first point that you believe you can substantially cut spending without cutting services is a familiar mantra that has been used by many before you. The fact is that we are spending below adequate maintenance of our assets. Examples include historically the sewer system and currently the capital assets that Chuck Hope referred to during the budget hearings.

Your second point about not holding people accountable could only be true if you don’t realize that “those” people are us. We did not spend enough to maintain our sewer system and got caught.

I understand the decision to postpone increased maintenance until we can feel more of the economic recovery next year, but I feel that we can only count on true stewards of the city like Councilman Hope to remind us to be responsible.

Trina Baughn says

“The fact is that we are spending below adequate maintenance of our assets.”

If that were true, we would not have the astronomical level of debt we have at over $200 million…..9 times that per capita as Anderson County or 7 times that per capita as the City of Knoxville.

Will you be managing the mayor’s campaign again this coming election?

Charlie Jerniga says

No, that just explains that we did not have excess revenue to pay for needed and desired spending without issuing bonds. Just like most folks get a mortgage sometime in their lives, we have borrowed and will pay these off over time.

The things that were not paid for, like sewer maintenance, have now joined the electorate endorsed high school renovation as large items on our debt.

Not spending needed operations/maintenance on our capital assets (like buildings) will prove to be very expensive in the future, like our sewers have become. We can learn a lesson from the federal building right here in Oak Ridge.

Let’s all try to be realistic and responsible.

TJ says

Your inflation rate of two percent is from the lying BLS. The real rate has been at least 8 percent annually. See John Williams shadow stats.

What causes inflation Pat? (See below)

Governments always grow larger and consume more of the available capital and resourses of a country. Often they kill the “golden goose”. Revolution or war is the result.

Inflation is an increase of the money supply without the corresponding increase in production is my definition.

As usual, speaking only for myself.

Denny Phillips says

I would think that as inflation and the CPI rise, the amount of sales tax collected would rise with it. For instance if milk costs $2 sales tax might be about $.19, but when milk costs $3 sales tax might be about $.28.

But then I don’t know much.

Charlie Jernigan says

I can’t respond to your last point, but as to the first…

Sales taxes do pick up inflationary increases more quickly than property values (not property taxes as has been explained ad nausea), but only for those purchases (excluding gasoline) made inside the taxing district. Since we have been bleeding spending dollars outside of Anderson County and the City of Oak Ridge for years, we do not have the benefit a large portion of the sales tax revenue here locally.

This explains the push for the return of retail to Oak Ridge and the expense of effort and incentives to make that happen.

Adequate sales tax revenue is the only way to make substantial reductions in property taxes (unless the state does an “about face” on income taxes to stop punishing only those saving for retirement or those already living on their savings).

Trina Baughn says

“Adequate sales tax revenue is the only way to make substantial reductions in property taxes”

Sales tax revenue is but ONE way . Substantial reductions can be made by prioritizing needs over wants, reducing luxury spending and by increasing the assessment base. Placing all of your bets on retail and restaurant revenue is myopic.

Charlie Jernigan says

By your arbitrary declaring some spending as luxuries and not needed, it is clear that you do intend to cut services.

It should be noted that when we have put these kinds of questions to our citizens, they have opted to continue to pay for their services. If you want to go after people’s back door garbage pickup or recycling or the library or the schools or … , you will soon become known for those choices and your good intent will have been wasted.