In 2003, the Anderson County Commission approved a county subsidy for a revitalization project at the Oak Ridge Mall.

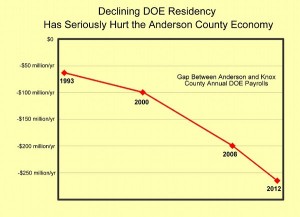

Had that project succeeded, it would have generated a substantial increase in county revenue, allowing tax rates to be lowered. A successful mall project would have also helped stabilize the U.S. Department of Energy payroll gap with Knox County. Stabilizing this gap would have generated nearly $100 million more in DOE payroll for the Anderson County economy—in this year alone.

Obviously, the potential economic benefit from a successful mall project is huge.

To give the project the best chance for success, the Commission needs to couple the requested mall subsidy to four key Commission actions:

- “Sell Anderson County” to the DOE workforce (with its billion dollar DOE payroll). Unfortunately, two decades of bad press from Knox County realtors have created a major image problem for Anderson County. Anderson County is a wonderful place to live—with great schools and many other advantages. And the ongoing recession (with the high price of gas) makes our convenient location a real plus for DOE workers. The commission needs to ensure that the advantages of living in Anderson County are sold to the “billion dollar” DOE workforce.

- Require that Oak Ridge hold the city economic development staff and the Industrial Development Board accountable for the success of the mall project. A second failure in developing the mall property will have a significant impact on the school systems in Anderson County, on its police and fire services, and on the ability of Oak Ridge to pay off its sizable city debt. Last time, the city staff and the IDB were not held accountable. New faces with fresh ideas will be needed if the current project fails to either: (1) generate the expected county revenue or (2) end the loss of DOE payroll from Anderson County within, say three years.

- Monitor the project throughout the life of the tax increment financing (TIF). The commission needs to periodically review the progress of the project throughout the life of the tax subsidy—so that adjustments can be made to keep the project on track and successful.

- Require the tax increment financing subsidy be re-authorized if: (1) the project is not completed within three years or (2) more than 20 percent of the retailers in the project at any time are pre-existing Anderson County retailers. The county cannot afford to see the property tied up for another decade without meaningful development progress. Also, re-locating existing Anderson County retailers to the mall property does not help expand the overall county economy.

Last time, the commission put money on the table and walked away. This time, the commission needs to stay involved—and help the mall project succeed.

The ultimate prize is the billion dollar DOE workforce and the economic future of the county.

Leave a Reply